Financials

Financial management software designed for strategy and performance

Empower your finance team to concentrate on strategy and performance with Financials. Designed to bring clarity to complexity, it keeps you organised, drives smarter decisions, and helps you focus on what truly matters for your organisation.

30+ years supporting finance teams

Empower Your Finances with Financials: Robust and Flexible Accounting Solutions

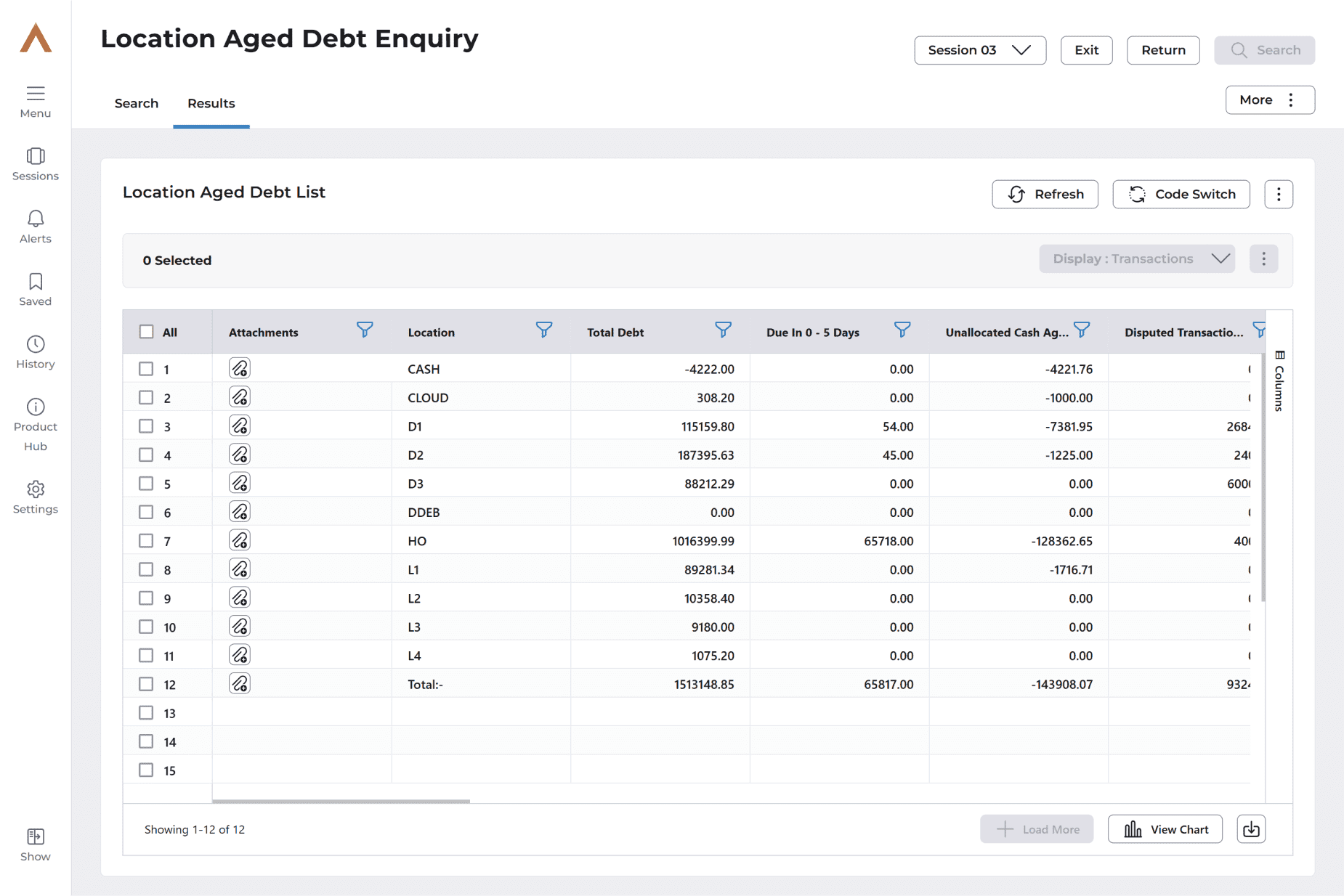

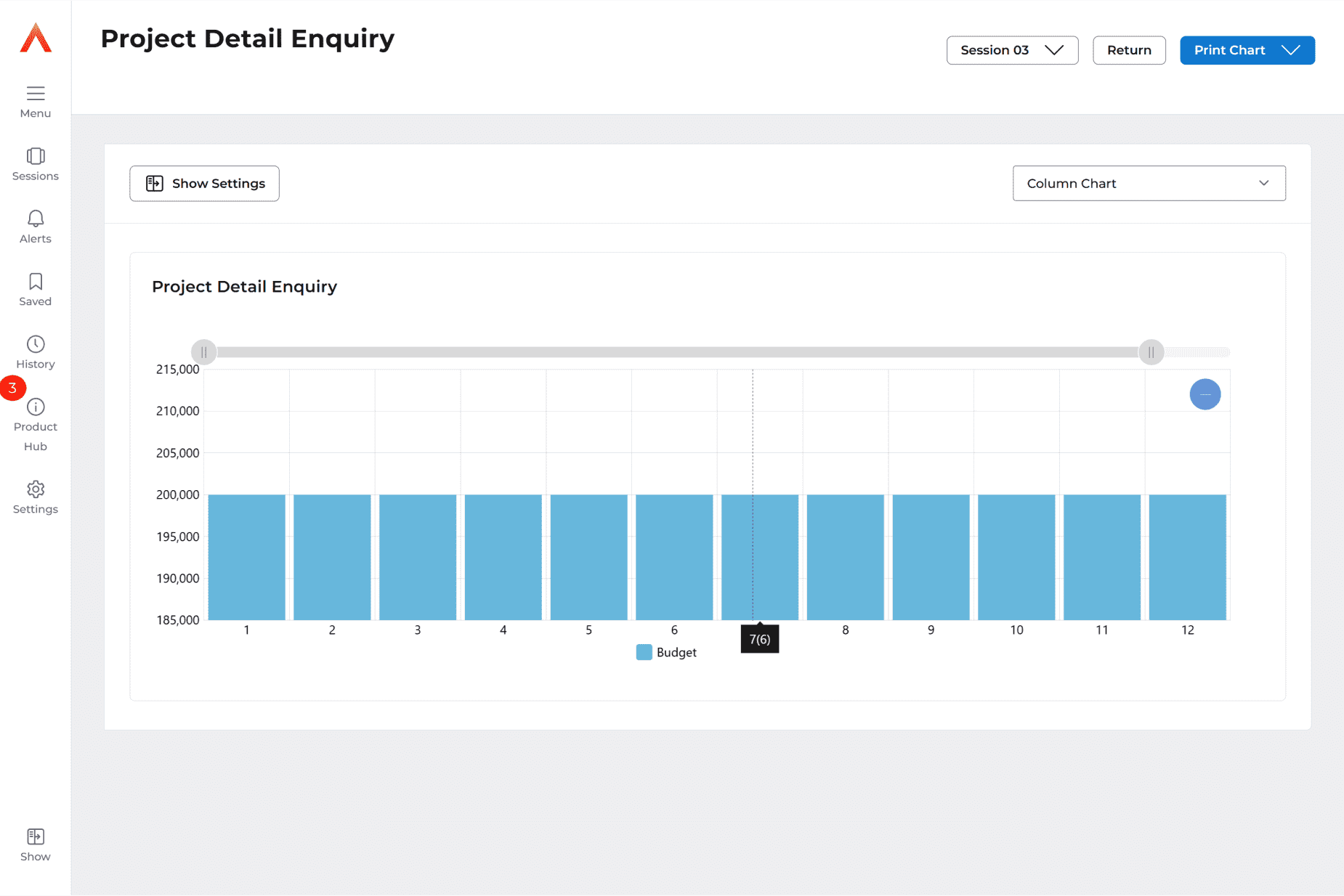

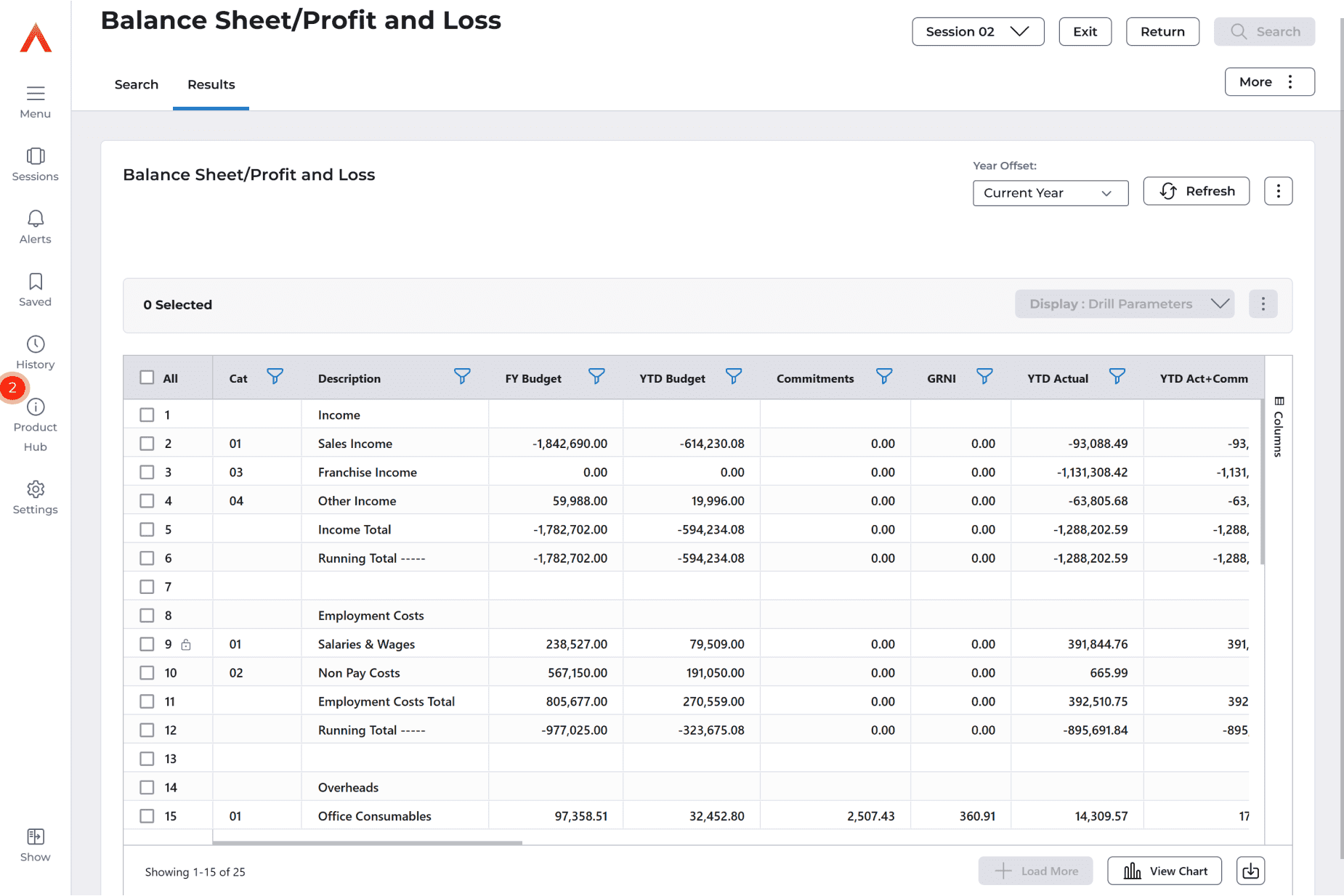

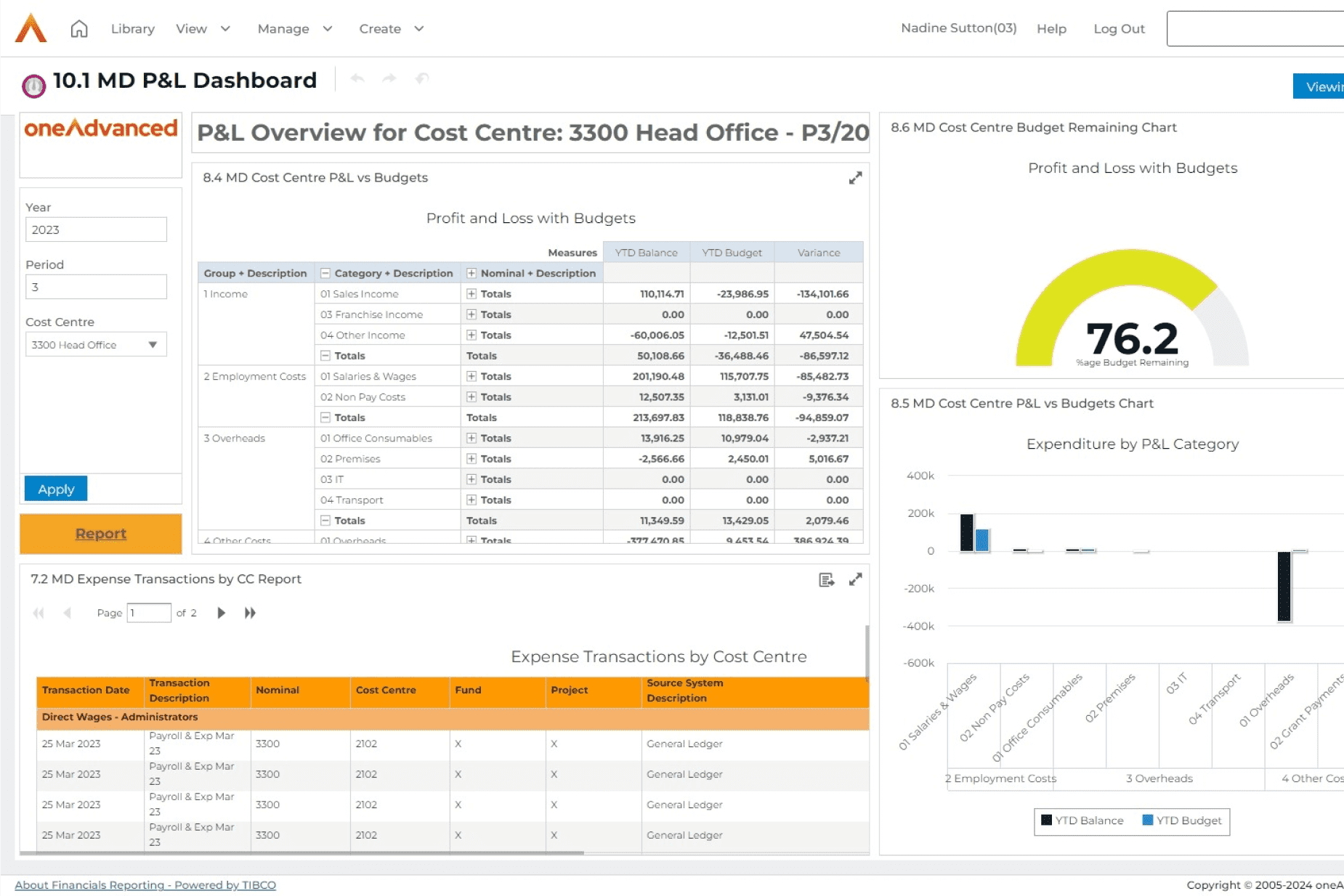

Real-time insights that empower you to make smarter, data-driven decisions

Use real-time analytics to understand trends, embrace opportunities and proactively address challenges. Give your team the insights they need to refine strategies, improve performance and achieve better results.

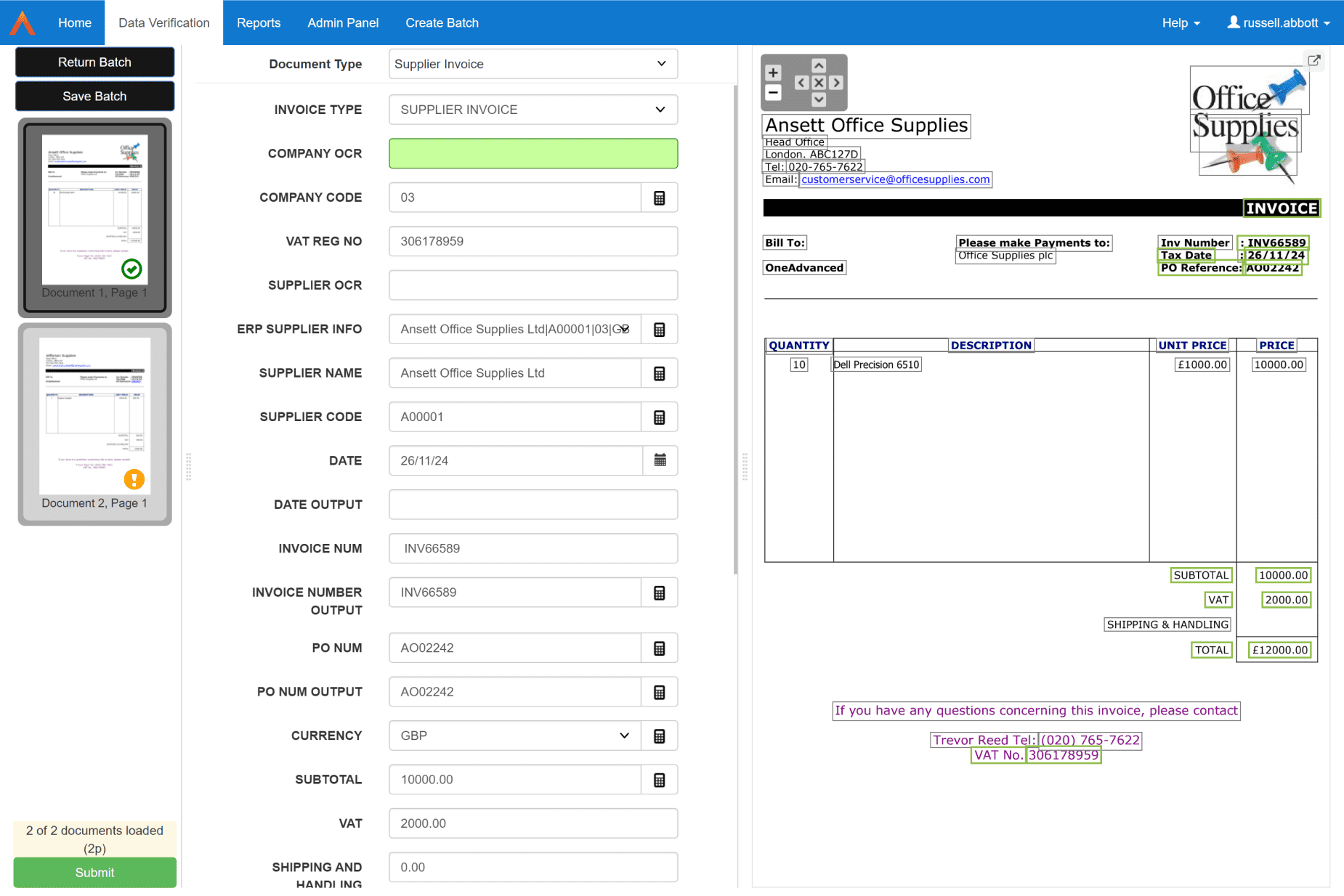

Increase efficiency through automation, reducing manual tasks and saving time

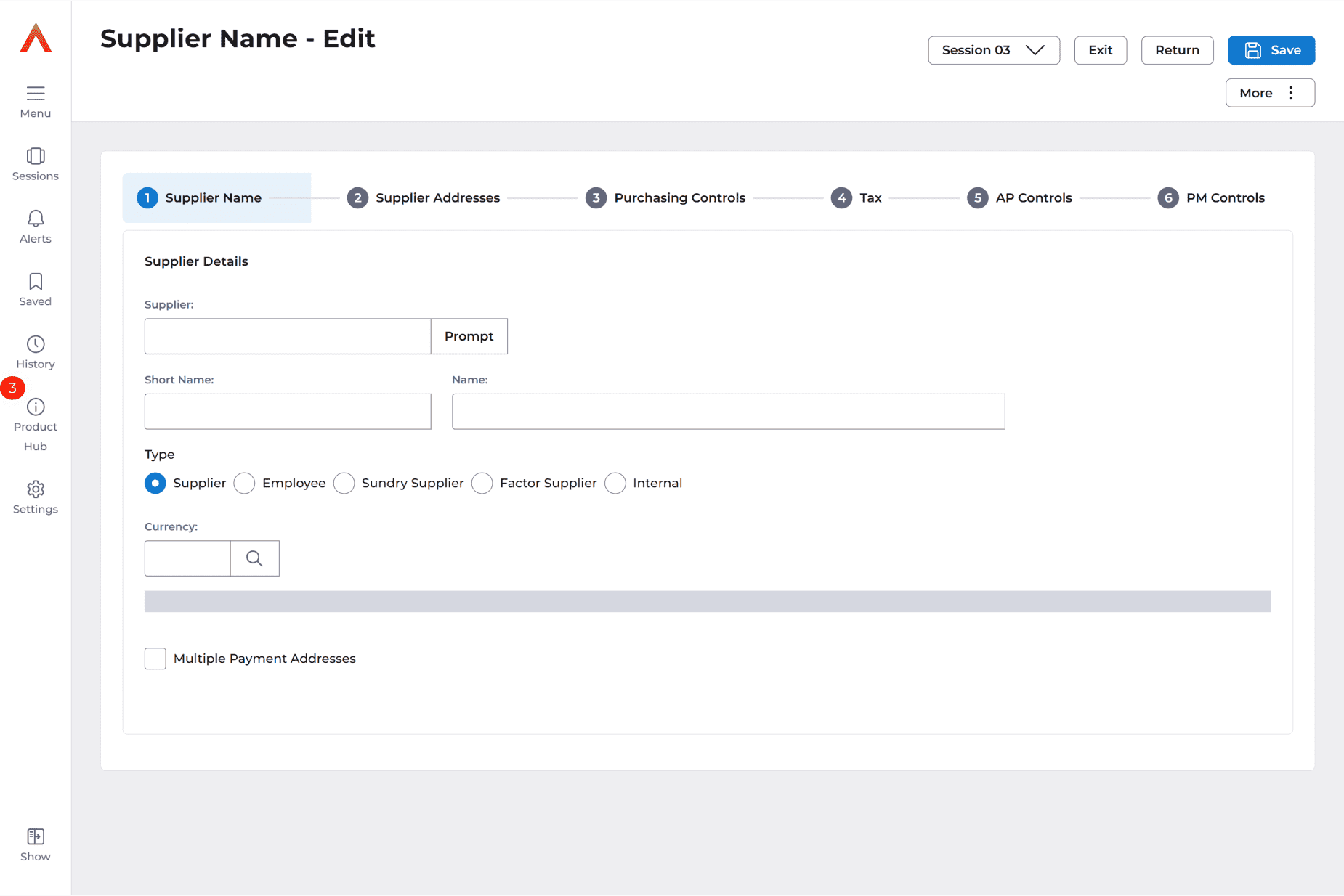

Automation is the key to increasing efficiency by removing repetitive manual tasks. Save time and focus on what truly matters. From data entry to reporting, automation helps reduce errors, improve accuracy, and free up resources for more strategic work.

Enhanced self-service capabilities

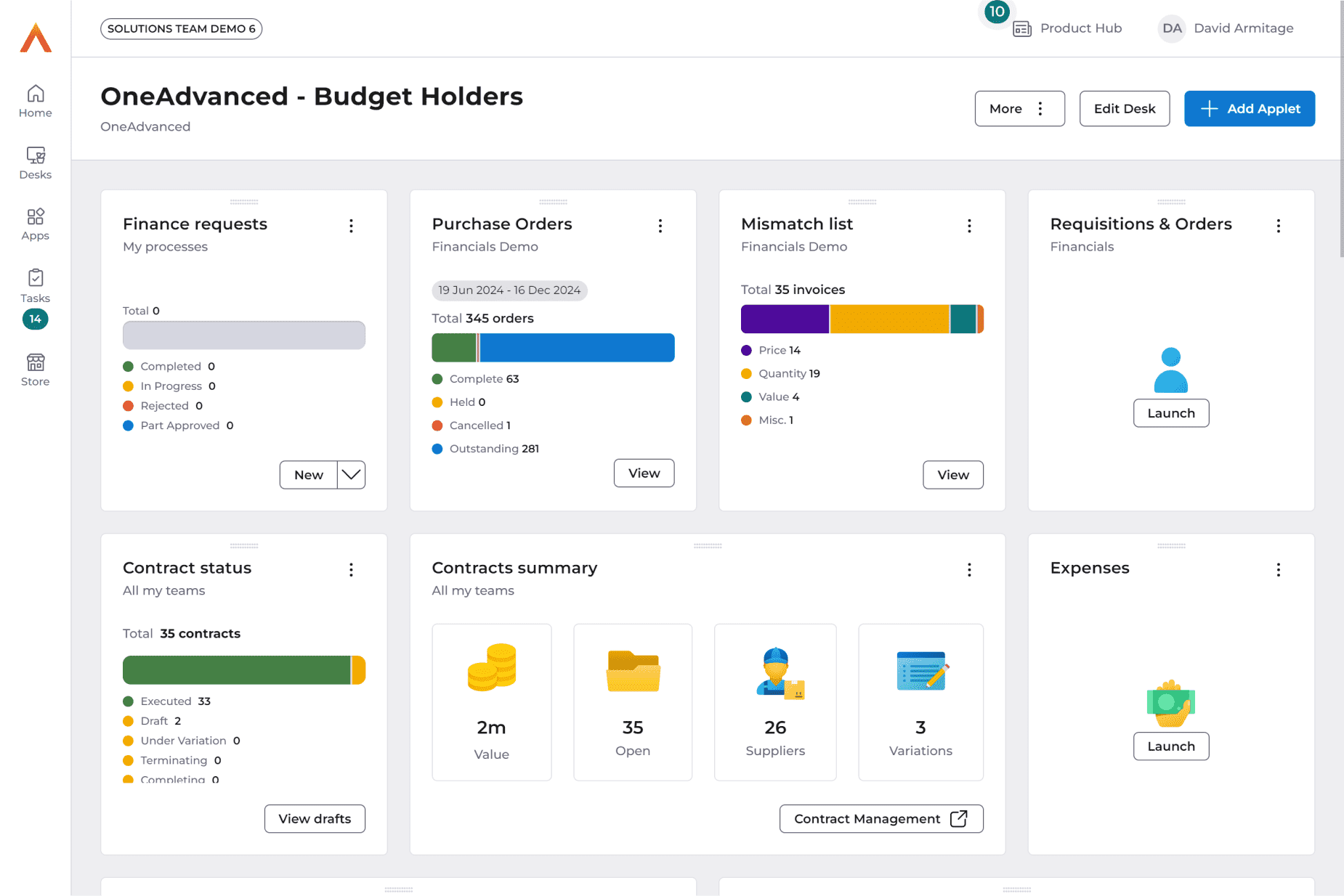

Enhance your self-service options with systems built for ease and convenience. Ensure your users can find exactly what they need, when they need it, without any frustration. Our composable user interface brings tasks and automation together to suit each user persona reducing noise and increasing efficiency.

Safe, Trusted, Secure

Your work powered by AI

Uncover the power of OneAdvanced AI. With UK data sovereignty, and custom privacy controls - you can deliver innovation without compromise.

Financial Management Software Features

Dashboards and queries

Informative, functional reports and customisable dashboards. Lead strategy based on accurate, real-time information with the ability to instantly see performance and financial health.

Financials Value Calculator

Find out how much our software could save your organisation

OneAdvanced not only managed this transition of our finance system, but they continue to support us in our Cloud-first strategy.

Julie Brown, Director of ResourcesCafcassThe detailed reporting and dashboard capabilities within Financials are fantastic. The ability to instantly deliver data to senior leadership in real time enables us to influence decision making, which we simply could not do before.

Pip Abercromby, Finance and Commercial DirectorWest Midlands Growth CompanyWe were really impressed by the reporting capabilities offered by Financials. Being able to drill down into our financial data easily and efficiently is crucial for us as we continue to scale.

Nick Playford, Finance Manager at MonavateMonavate

Powering your organisation

Our portfolio of sector focused software effortlessly gets the job done

Empowering health sector finance teams to manage complex processes with ease, accuracy and efficiency.

Our Financials system is here to support finance professionals in the health sector, helping you manage complex processes with ease, accuracy, and efficiency. We know how vital your role is in keeping health organisations running smoothly, which is why Financials is designed specifically to tackle your unique challenges.

- Financial Planning for Health: Plan, allocate, and track budgets with precision.

- Secure and Compliant: Navigate regulations with ease and create accurate, clear reports.

- Data-Driven Insights: Enhanced analytics for forecasts, trend analysis, and real-time financial visibility.

- Secure Cloud Access: Access data anywhere with industry-standard encryption and security enhancements.

- Boost Efficiency: Automate reports, invoicing, and expenses.

Enhance financial management in the care sector with modules designed for precision, compliance, automation, and improved decision making.

Managing finances in the care sector is no simple task. From balancing budgets to allocating resources effectively, the challenges are unique and demanding. That’s where our financial management system steps in – designed to provide the care sector with tools that simplify processes, improve accuracy and save valuable time.

- Real-Time Insights: Stay in control with live financial data that allows for quick, informed decision-making.

- Enhanced Workflows: Automate repetitive tasks like invoicing and payroll, saving valuable time and reducing errors.

- Secure and Compliant: Built to the highest standards of security and compliance, safeguarding sensitive information.

- Integrations: Work with your existing tools and systems, ensuring a smooth transition.

Optimise logistics finances with real-time cost tracking, simplified invoicing, custom reports, and easy integration.

Managing finances in the logistics sector can be challenging, with tight margins, fluctuating costs and complex invoicing processes. That’s where our financial management system comes in, designed to empower every aspect of your financial operations.

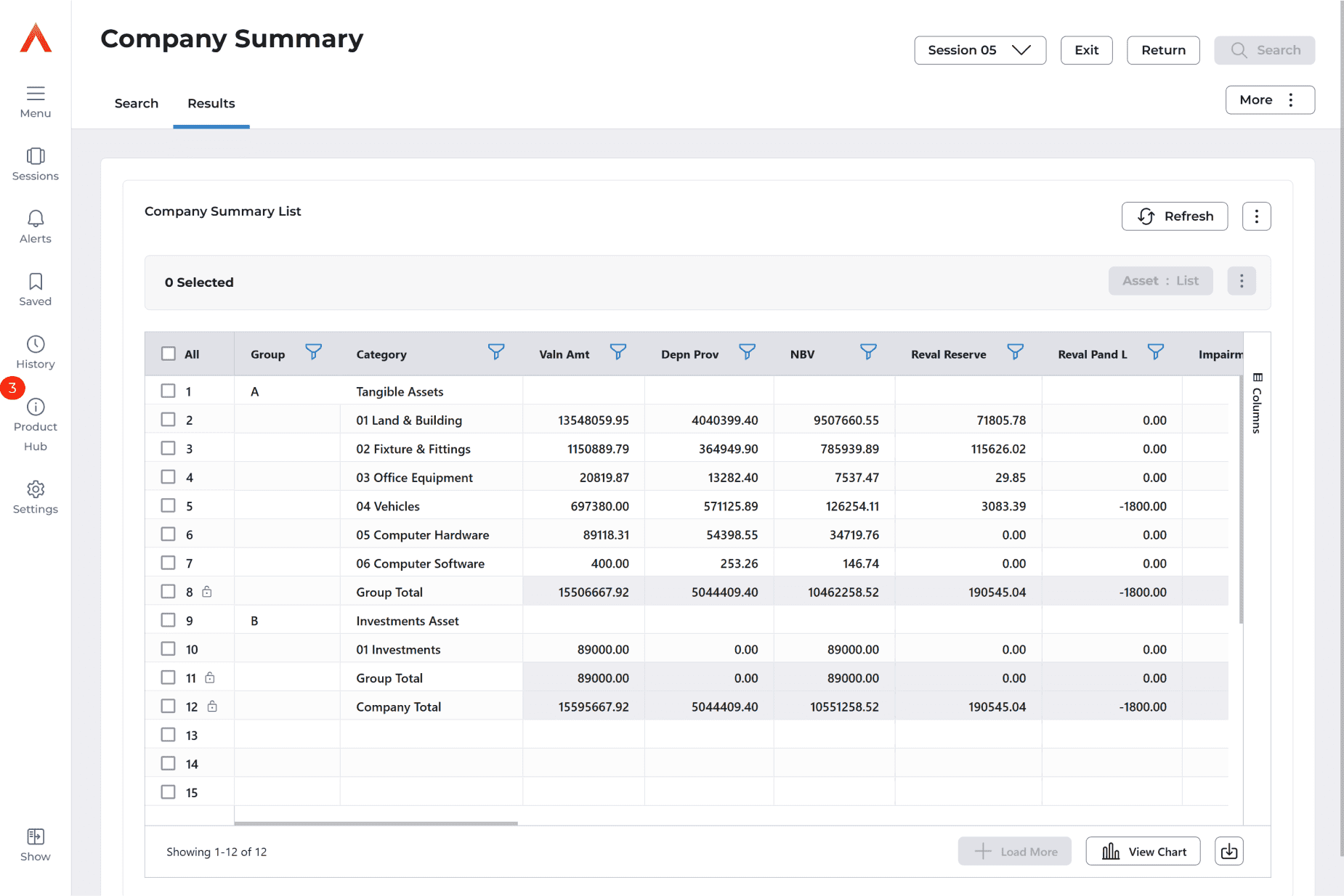

- Integrated Asset Management: A solution tailored for logistics, combining tracking, maintenance of fleet vehicles, warehouses, and supply chain assets in one centralised system.

- Automated Billing and Reporting: Eliminate manual errors and save time with fully automated invoicing and customisable financial reports.

- Real-Time Financial Insights: Get up-to-the-minute updates, helping you to make data-driven decisions when it matters most.

- Multi-Currency Support: handle multiple currencies with ease, reducing the risk errors.

- Regulatory Compliance: Stay ahead of evolving regulations with audit-ready financial records at your fingertips.

Empowering retail with automation, real-time insights, and POS integrations. Shift your focus from managing complexity to driving growth.

Our financial management system has been designed with retailers in mind, it simplifies complex workflows, freeing up your time to focus on what matters most—your customers and the growth of your business.

- Financial Workflows: Automates invoicing, and budget planning. Reducing manual errors while saving valuable time.

- Real-Time Financial Insights: Live dashboards with key metrics like revenue, expenses, and profit margins. Drives informed decision-making by providing actionable data at your fingertips.

- Multi-Channel Integrations: Integrates effortlessly with point-of-sale (POS) systems, e-commerce platforms, and inventory management tools. Provides a unified view of both online and offline transactions.

- Scalability for Growth: Adapts as your business expands, adding new locations or product lines.

- Secure and Compliant: Keeps all transactions safe with enhanced security. Simplify compliance with financial regulations specific to the retail industry, helping you avoid penalties.

Empower government finances with Financials: real-time reporting, automated workflows and scalable solutions.

Financials is designed to modernise government operations, ensuring efficiency, transparency and compliance. By addressing the unique challenges of public sector finance, we provide solutions that empower government organisations.

- Budget Management: Enable efficient allocation and tracking of bugets with intuitive tools tailored to meet governmental needs.

- Integrated Asset Management: Enhance government operations with integrated asset management, enabling efficient tracking, maintenance, and optimisation of assets to maximise value and support community needs.

- Regulatory Compliance: Ensure adherence to evolving fiscal policies, helping you stay aligned with government standards and minimise risks.

- Powerful Reporting Tools: Generate detailed financial reports easily, offering transparency and data-driven insights to support better decision-making.

- Secure Data Handling: Leverage enhanced security features to protect sensitive financial information.

- Flexible Integration: Easily integrate with existing systems, reducing disruptions and maximising efficiency.

Empower housing sector finances with real-time data, automation and simplified workflows for better accuracy and efficiency.

Our financial management system is specifically designed to address the unique challenges faced by the housing sector, offering a comprehensive and reliable solution to enhance operations and drive success.

- Integrated Asset Management: A solution that combines tracking, maintenance, and optimisation of all your assets in one centralized system.

- Real-Time Reporting: Gain clear, real-time insights into your organisation’s financial health with customisable dashboards and detailed analytics.

- Compliance Made Easy: Stay ahead of regulatory requirements with features designed to ensure your operations remain compliant.

- Optimise Budget Management: Allocate resources more effectively and ensure that every pound spent contributes towards your organisation's goals.

Empower financial management in education with Financials. Effortlessly automate budgeting, monitor expenditures, and maintain compliance. Achieve smarter, more efficient financial oversight.

Managing finances in the education sector can be complex and time consuming. That’s why we’ve designed a financial management system tailored to meet the unique needs. Our solution helps organisations simplify financial processes, ensuring compliance, transparency, and efficiency every step of the way.

- Budgeting and Reporting: Automate complex budgeting processes and generate clear, compliant financial reports in just a few clicks.

- Integrated Asset Management: Streamline and optimise l operations with integrated asset management, combining tools and processes to track, maintain, and maximize the value of educational resources like technology, equipment, and facilities efficiently.

- Customisable Dashboards: Personalise your interface to focus on the financial metrics that matter most to your institution.

- Real-Time Tracking: Monitor spending across departments in real-time to maintain control and reduce unnecessary costs.

- Integrations: Easily align our system with your current tools and student management systems for a unified operational workflow.

- Data Security and Compliance: Ensure sensitive financial data is protected and meets all regulatory requirements.

Why work with OneAdvanced?

We provide full solutions that effortlessly get the job done, allowing our customers to focus on thriving for the people who rely on them.

Solutions for your sector.

We leverage unparalleled sector experience to provide software and services that help you get the job done.The power of people

Our dedicated professionals are ready to connect with you and find the solution that makes a difference.Putting you first

We put our customers first in everything we do, making sure that the work we do is focused on the needs of your team.FAQs

Contact our sales and support teams. We’re here to help.

Speak to our expert consultants for personalised advice and recommendations or to book a demo.

Call us on

0330 343 4000Please enter your details, and our team will contact you shortly.

All fields are required

From simple case logging through to live chat, find the solution you need, faster.

Support centre